Explore our glossary to gain a clear understanding of key terms related to Total Addressable Market (TAM). This in-depth guide is designed to enhance your comprehension of market analysis and strategic planning, providing valuable insights into leveraging TAM for business growth.

What is Total Addressable Market (TAM)?

The Total Addressable Market (TAM) is a critical baseline factor crucial for businesses to understand the total revenue opportunity available if their product or service achieves 100% market penetration. It represents the maximum potential of a company’s offerings within its target market.

By engaging in thorough market research and understanding the fundamentals of the market, businesses can perform a comprehensive TAM analysis. This involves TAM calculation, which helps to formulate effective growth strategies and set realistic business goals.

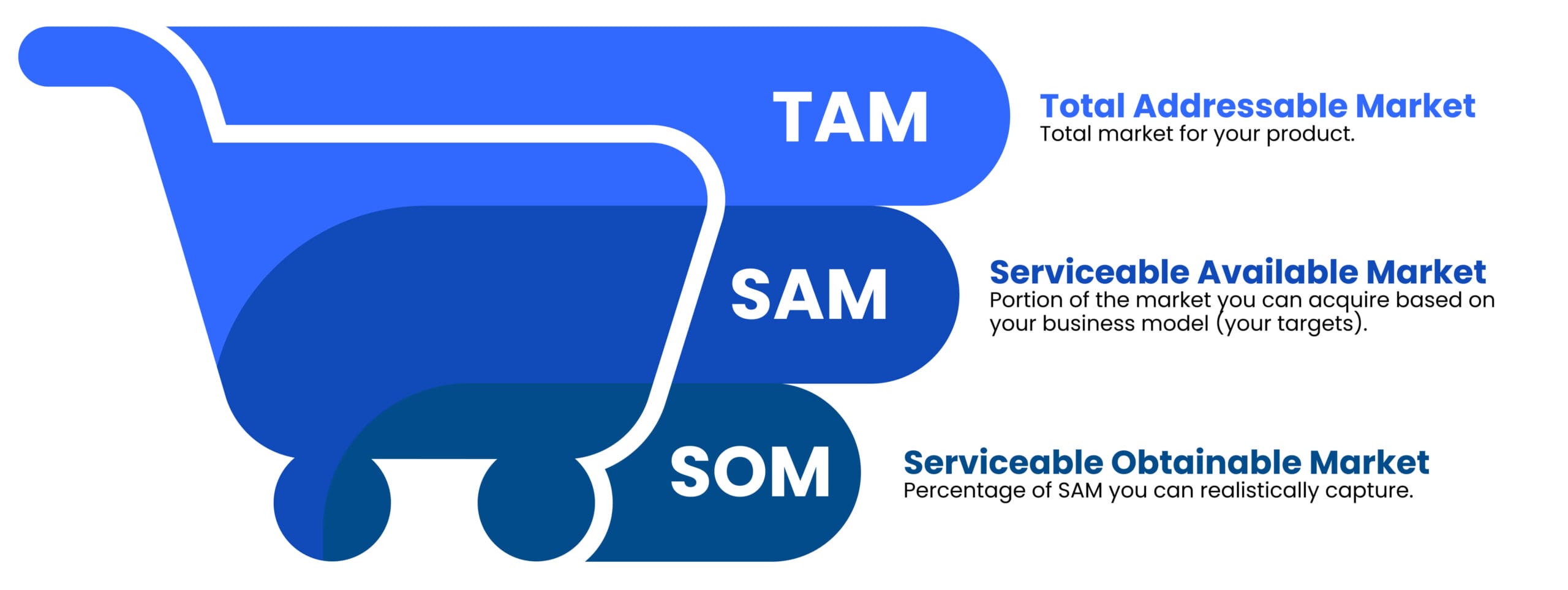

Understanding TAM alongside related customer segmentation lists like Serviceable Available Market (SAM) and Serviceable Obtainable Market (SOM) is essential. These market groupings help companies assess the market size they can realistically reach and achieve.

For instance, SAM represents the portion of TAM that a company’s products can address, considering geographical and market constraints. Similarly, SOM is the share of SAM that the business can capture, factoring in competition and resources.

Why is the Total Addressable Market Important?

Estimating the Total Addressable Market (TAM) is crucial for:

- Guiding Strategic Decisions: TAM helps determine whether a market is large enough to justify investment.

- Allocating Resources Effectively: By knowing their full potential, businesses can better allocate budgets and resources.

- Defining Long-Term Goals: Setting achievable targets becomes easier with a clear understanding of TAM, SAM, and SOM.

These insights are particularly valuable in Account-Based Marketing (ABM), where businesses target specific, high-value accounts rather than a broad audience. By aligning ABM strategies with TAM data, companies can prioritise accounts that represent the greatest revenue opportunities.

Methods for Calculating Total Addressable Market

There are a number of methods businesses can use to calculate TAM. Each approach has distinct benefits and can offer unique insights, depending on the nature of the business and market.

1. Top-Down Approach

The top-down approach to calculating TAM starts by using broad market data from reputable sources like industry reports. This data is then narrowed down to focus on a specific segment relevant to the business.

- Formula: TAM = (Refined Market Segment Size) x (Average Revenue per Customer)

- Example: For a new project management software, a company could begin by identifying the total number of businesses worldwide and then narrow this to those most likely to need project management tools, such as small- to medium-sized enterprises (SMEs).

2. Bottom-Up Approach

The bottom-up approach starts at a local level, using internal sales data or customer metrics to estimate the market potential if scaled up.

- Formula: TAM = (Average Revenue per Customer) x (Total Number of Potential Customers)

- Example: A business could calculate the average revenue per customer, multiply it by the total number of potential customers within the target region, and then scale this calculation to reflect the broader market. This approach tends to be more precise, particularly in well-defined markets.

3. Value-Theory Approach

This method, also known as the value theory approach, estimates TAM by assessing the value offered by the product or service and what customers are willing to pay.

- Formula: TAM = (Estimated Price per Customer) x (Number of Potential Customers)

- Example: For an innovative product that creates a new market category, such as an advanced software solution, the TAM could be based on customer feedback regarding pricing or similar products in the market.

4. External Research

A fast way to gauge TAM is to use third-party research, particularly if industry reports are available. Reports from sources like Gartner and Forrester can provide insights into market potential, though the data may lack the granularity specific to the company’s offering.

Addressing Common Pitfalls in TAM Calculation

Calculating TAM can be fraught with challenges. Here are some common pitfalls and how to avoid them:

Overestimating Market Size: Avoid using overly broad data that doesn’t accurately reflect your specific market. Focus on reliable, up-to-date sources and ensure the data you use is relevant to your product or service.

Neglecting Competition: Remember that TAM doesn’t account for the competitive landscape. Always factor in existing competitors and potential new entrants when estimating your reachable market.

Ignoring Market Dynamics: Market conditions can change rapidly due to technological advancements or economic shifts. Regularly update your TAM calculations to reflect these changes and ensure they remain relevant.

Key Related Segmentations Metrics: SAM & SOM

Alongside TAM, two additional segmentations can further refine market assessments:

1. Serviceable Available Market (SAM)

SAM represents the portion of TAM that a company’s products or services can realistically reach based on factors such as location, industry restrictions, and market requirements. SAM essentially narrows TAM to an accessible segment.

- Example: If a business’s TAM includes all global SMEs, SAM would focus on SMEs within regions where the company operates and has distribution channels.

2. Serviceable Obtainable Market (SOM)

SOM is the percentage of SAM that a business can realistically capture, considering competition and resource limitations. It is often calculated as a percentage of SAM and reflects achievable market share.

- Example: If SAM includes all SMEs in the UK for a project management tool, SOM would be the market share the business could expect to capture within the UK based on its resources, competitive positioning, and market reach.

Practical Examples of TAM, SAM, and SOM

To illustrate how these concepts work together, consider an example:

- Total Addressable Market (TAM): The TAM for an online educational platform might include all institutions globally that offer online learning.

- Serviceable Available Market (SAM): The SAM would be educational institutions in regions where the platform’s technology and infrastructure are compatible.

- Serviceable Obtainable Market (SOM): The SOM would represent a realistic target, such as capturing 15% of SAM over five years due to competitive factors.

Why Total Addressable Market (TAM) is Essential for Account-Based Marketing (ABM)

Understanding the Total Addressable Market (TAM) is particularly advantageous In Account-Based Marketing (ABM), where resources are strategically focused on high-value accounts rather than a broad audience. TAM provides the foundation for identifying and prioritising accounts that align with the greatest revenue potential, helping businesses achieve more impactful results with targeted efforts.

1. Identifying High-Value Accounts

TAM analysis gives ABM teams a clearer picture of where the highest-value accounts reside within the market. By understanding the total market size and segmentation, businesses can pinpoint accounts that align most closely with their ideal customer profile, ensuring resources are allocated toward clients with the highest potential for return on investment.

Discover strategies to boost your marketing ROI through effective CRO techniques.

2. Aligning ABM Strategies with Realistic Market Data

Aligning ABM strategies with TAM ensures that teams set goals grounded in realistic market data. By evaluating the TAM, ABM strategies can be adjusted to focus on markets with substantial potential rather than pursuing scattered, smaller opportunities. This alignment helps to define a clear, evidence-based path toward revenue goals, ultimately making campaigns more efficient and results more predictable.

3. Prioritising Key Accounts and Resources

With TAM as a guide, ABM teams can better prioritise accounts that offer the greatest value, focusing resources on securing and nurturing relationships with key clients. This prioritisation leads to better use of time, personnel, and budgets, reducing the likelihood of resource strain or wasted efforts on low-potential accounts. It also helps align cross-functional teams—such as sales and marketing—by focusing on shared high-impact goals.

4. Supporting Long-Term Growth in ABM

TAM not only guides short-term account selection but also supports the long-term growth strategy of an ABM programme. By basing decisions on an understanding of the full market opportunity, ABM teams can build a scalable strategy, expanding focus to include new high-value accounts as they develop a stronger presence in the market.

Read our ABM articles to learn about the power of intent data in refining your ABM results and to Enhance your ABM strategy with easy-to-implement personalisation tactics.

How to Use TAM for Strategic Planning

Calculating and understanding TAM, SAM, and SOM provides businesses with critical insights for setting realistic and achievable goals, particularly in the following areas:

- Product Development: By understanding market potential, businesses can tailor product features to meet the needs of the most profitable segments.

- Sales and Marketing Alignment: These metrics help teams focus efforts on high-impact accounts, crucial for Account-Based Marketing (ABM) strategies.

- Resource Allocation: Knowing the market’s full potential helps to make informed decisions about budget allocation and workforce distribution.

- Investment Attraction: Having a clear TAM analysis can help attract investors by showing the scalability and revenue potential of a business.

How to Select the Best TAM Tool or Calculator

Choosing the right Total Addressable Market (TAM) tool or calculator is essential for accurate market analysis and strategic planning. Here are some considerations and top companies offering excellent solutions:

Key Considerations:

- Data Accuracy: Ensure the tool uses up-to-date and comprehensive databases to provide reliable market insights.

- User Interface: Look for a tool that is intuitive and easy to navigate, allowing you to input data and obtain results quickly.

- Customisation Options: Select calculators that allow you to tailor inputs according to your specific industry or product needs.

- Integration Capabilities: Consider if the tool can integrate with your existing systems or software for seamless data flow.

Top Companies Offering TAM Calculators:

- Clearbit: Known for its extensive database of over 50 million companies, Clearbit offers a free TAM calculator that delivers instant and accurate market assessments.

- Dealfront: Dealfront provides a user-friendly TAM calculator designed for quick and efficient market analysis, making it a popular choice among businesses.

- YesChat: This platform offers a comprehensive TAM/SAM/SOM calculator, which is particularly useful for detailed market size calculations.

Conclusion

Understanding the Total Addressable Market (TAM) and the related segmentation metrics SAM and SOM is vital for any business aiming to grow strategically. These metrics offer a structured approach to analysing market potential and making informed decisions on resource allocation and product development. For businesses engaged in Account-Based Marketing (ABM), TAM is an especially valuable segmentation metric that helps identify high-value accounts and prioritise efforts accordingly.

FAQs

To calculate the market size of a SaaS product, identify the total number of potential customers within your target market and multiply this by the average revenue per customer. This gives you the Total Addressable Market (TAM). Use methods such as top-down or bottom-up approaches to refine your estimates based on industry data or historical sales.

A good size TAM for a new business venture typically ranges between $30 million and $200 million per year. This range indicates sufficient market demand to support growth with manageable competition levels. The ideal TAM size can vary depending on industry norms and business goals.

If the TAM is too small, consider expanding your product offerings or exploring adjacent markets to increase potential revenue opportunities. Alternatively, focus on niche markets with high growth potential or competitive advantage, where you can capture significant market share.

TAM analysis provides businesses with insights into market potential, helping to inform strategic decisions, resource allocation, and investment opportunities. It enables them to assess new product viability and align business strategies with market dynamics.

Understanding TAM is critical as it helps businesses determine their scalability and revenue potential. It is essential for evaluating growth opportunities, securing investor confidence, and setting realistic business targets.

Overestimating TAM can lead to misallocated resources, unrealistic financial projections, and misguided business strategies. It is crucial to use accurate data and realistic assumptions to ensure TAM calculations reflect true market conditions.

A company should reassess its TAM annually or whenever significant market changes occur, such as technological advancements, regulatory shifts, or when new competitors enter the market. Regular reassessment ensures business strategies remain aligned with current market realities.